Seven out of ten brokers express optimism about future growth in the short-term lending market. 📈

Research by specialist lender Black & White Bridging found 37% of brokers are positive about the future of the market over the next year, with another 35% describing themselves as very positive. Only 7% of brokers described themselves as negative on growth (none were very negative), with the remainder (14%) describing themselves as “neutral”.

When asked if they expected to see an increase in demand for bridging loans over the next 12 months, 74% of brokers said they did. While 24% expected to see no change in deal volumes, only 2% expected to see a decrease in demand.

Overall, brokers said they expected to see 16% more deals in 2025 than in 2024, with one in every seven brokers (14%) forecasting demand to increase by more than 20%.

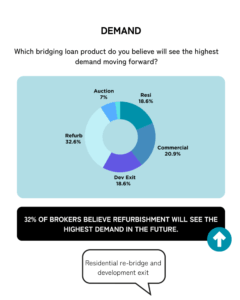

Refurbishment leads demand 🛠️

Brokers said they thought refurbishment products would be the bridging loan product in the highest demand in the future (33%). More than a fifth (21%) forecast commercial products would be in highest demand, followed by development exit or residential products (both 19%). One in 14 brokers (7%) predicted auction products would see the highest demand in the future.

Damien Druce, Chief Operating Officer of Black & White Bridging, said:

“The overwhelming optimism of brokers highlights not only the resilience of the short-term lending market but also its potential. With 74% of brokers anticipating a rise in bridging loan demand – and refurbishment products leading the charge – it’s clear brokers see significant opportunities ahead. We’re committed to supporting this growth with innovative products and tailored solutions to meet the diverse needs of borrowers in 2025 and beyond.”

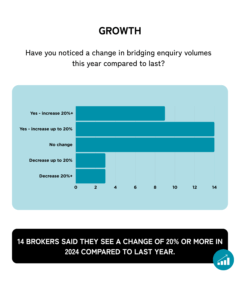

Current trading is already positive 📈

The positive forecasts come on the back of strong current trading. More than half of brokers (53%) said enquiries were currently higher than they were 12 months ago. While one third (33%) said enquiries hadn’t changed, only one in seven (14%) said enquiries were down.

On the whole, brokers said they had noticed bridging enquiries rise by almost a fifth in the last year (19%).

Damien said:

“Current robust business volumes confirm the market is thriving and suggest these forecasts are not pie-in-the-sky stuff. The surge in current trading, with 53% of brokers reporting higher enquiries over the course of the last 12 months and, overall, a 19% rise in bridging loan volumes over the past year, offers a solid bedrock for optimism about the future. Brokers have every reason to be confident in the opportunities ahead.”

Transparent lending criteria sought

When asked what factors matter when choosing a provider for bridging finance, the most common answer from brokers was “Transparency and certainty of outcome” (58%) followed closely by “Direct access to lending managers and underwriters” (56%) and “Speed” (53%) [respondents could select multiple options]. “An efficient process” was important to 44% of brokers, and “Strength of relationship” was selected by 37 per cent. “Reputation” was selected by 30% of brokers.

Commenting on the question, one broker said: “I’m driven by achieving the best possible outcome for my client, what that looks like varies from client to client and deal to deal”. Another added: “Total costs to client”, which suggests that brokers are operating in their client’s best interest.

On what can prove a contentious topic of discussion regarding the presentation of criteria by lenders, 48% of respondents said that lenders should disclose the full range of criteria for their lending products, ideally formatted as ‘from XX, up to XX’. One broker commented: “Lenders should set pricing for LTV and property type”, which suggests that brokers do want full transparency when reading through lenders’ criteria.